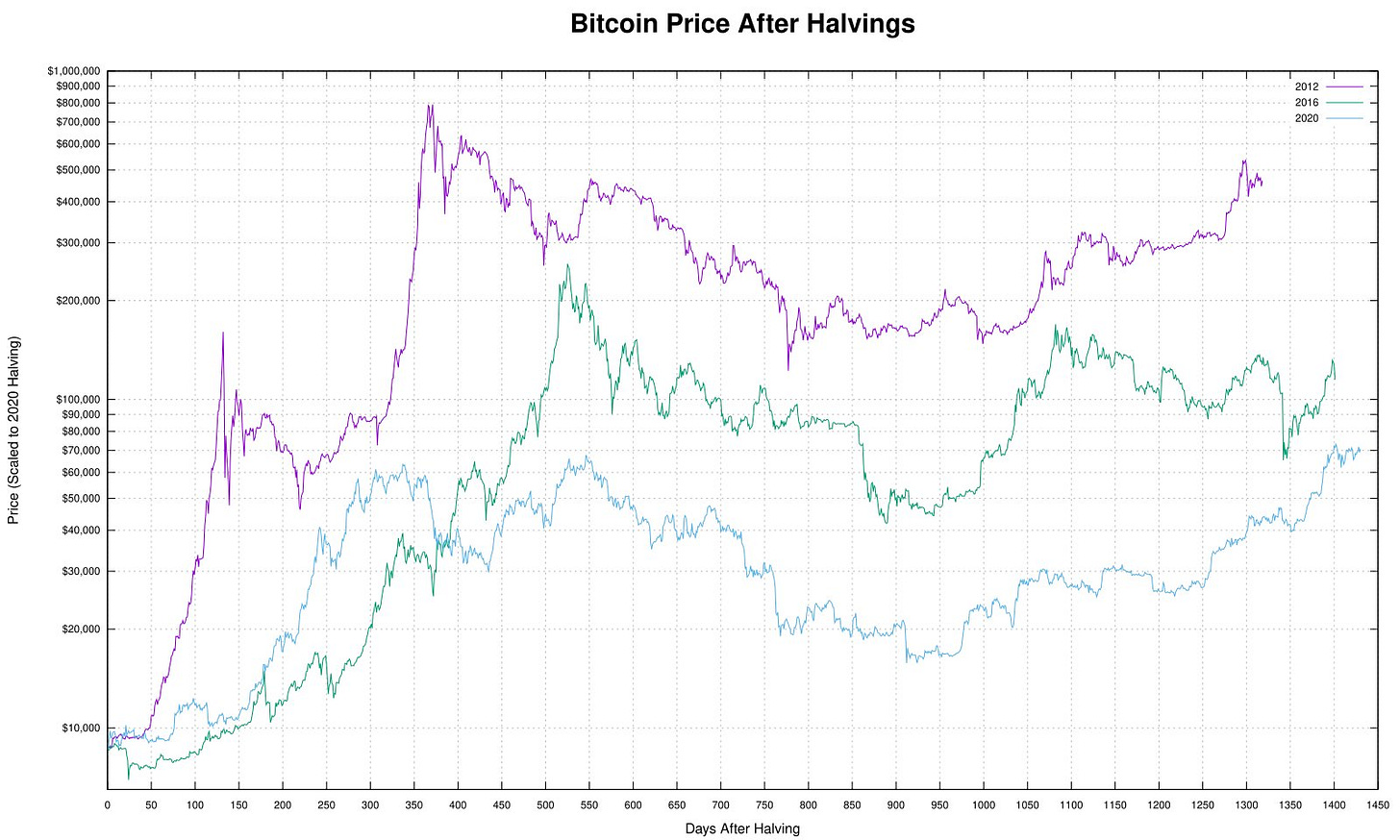

I thought I would share my thoughts with the upcoming Bitcoin halving event scheduled to occur this weekend. Bitcoin operates in 4-year cycles and typically sees a large amount of price appreciation in the 6-9 months after each halving event, which has the effect of reducing the block reward for Bitcoin. The current reward schedule is 6.25 Bitcoin mined worldwide every 10 minutes. Miners compete in a system by utilizing hash power from specialized computers to solve each Bitcoin block. Most miners work in pools to increase the possibility of obtaining a block (along with miner fees) which is then distributed based on contributed hash power to the pool.

Beginning this weekend (April 19/20, 2024), the Bitcoin reward schedule drops from 6.25 to 3.125 Bitcoin per block reward at block height 840,000. Each block produces a timestamp with the goal being for this to occur every 10 minutes. If a large amount of hash power is added to the network, block times may drop to the 7-8 minute mark. Should this happen, the Bitcoin protocol readjusts the difficulty of solving a block based on corresponding hash power every 2016 blocks (~2 weeks).

Why was this done?

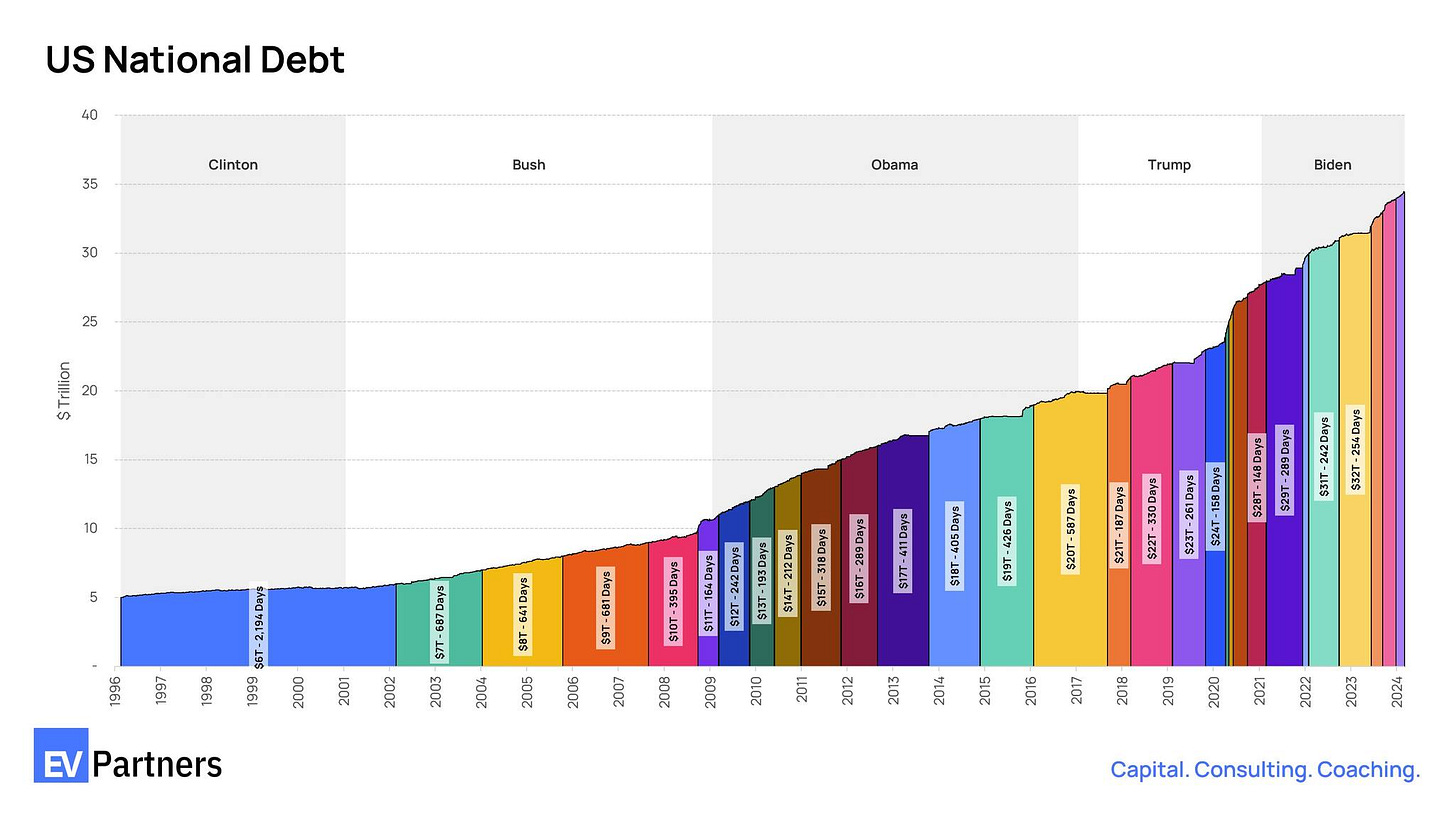

Conventional FIAT currencies are subject to inflation due to the ability of governments or banks to increase the money supply. Unlike these currencies, Bitcoin has a total supply limit of 21,000,000 BTC, meaning no additional coins can be created beyond this limit. Ever. This finite supply, alongside potential changes in global demand for Bitcoin, positions it similarly to gold - a resource with a supply limited by the amount mined each year. On the other hand, the US Government adds $1 Trillion in debt every 100 days at our current rate demonstrating the status quo of infinite money printing.

Each bar in the chart above represents the time taken to add an additional Trillion dollars to the National Debt.

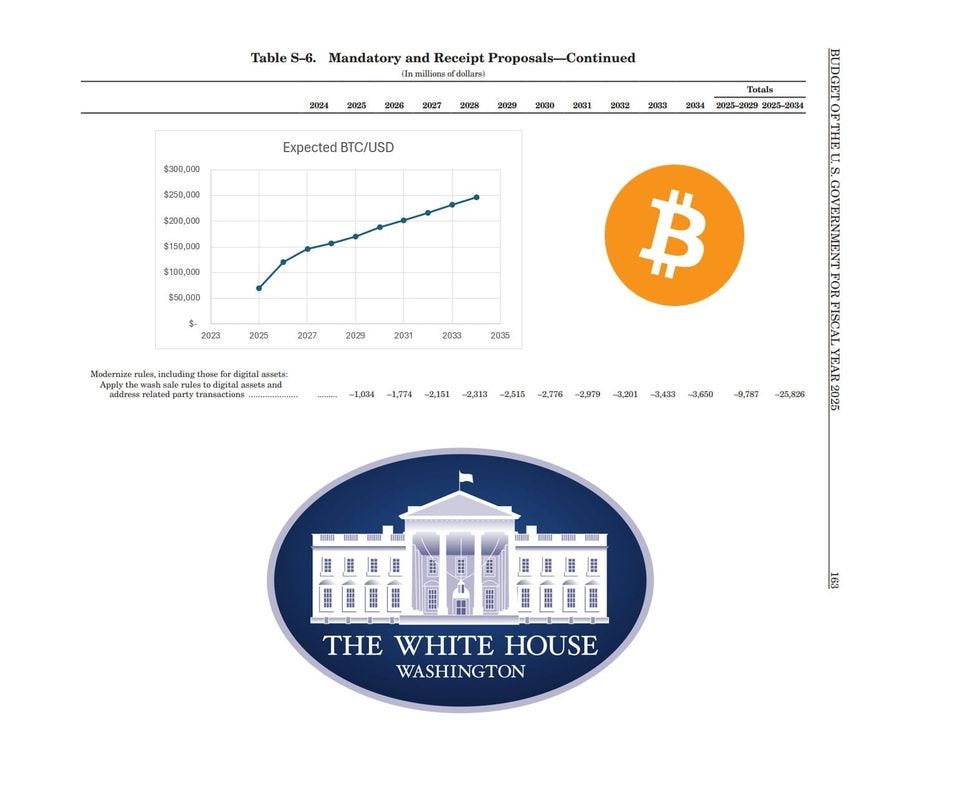

Even the US government has come to recognize the potential long-term upside in tax revenue from Bitcoin, with estimates for additional tax revenues of $250k by 2035.

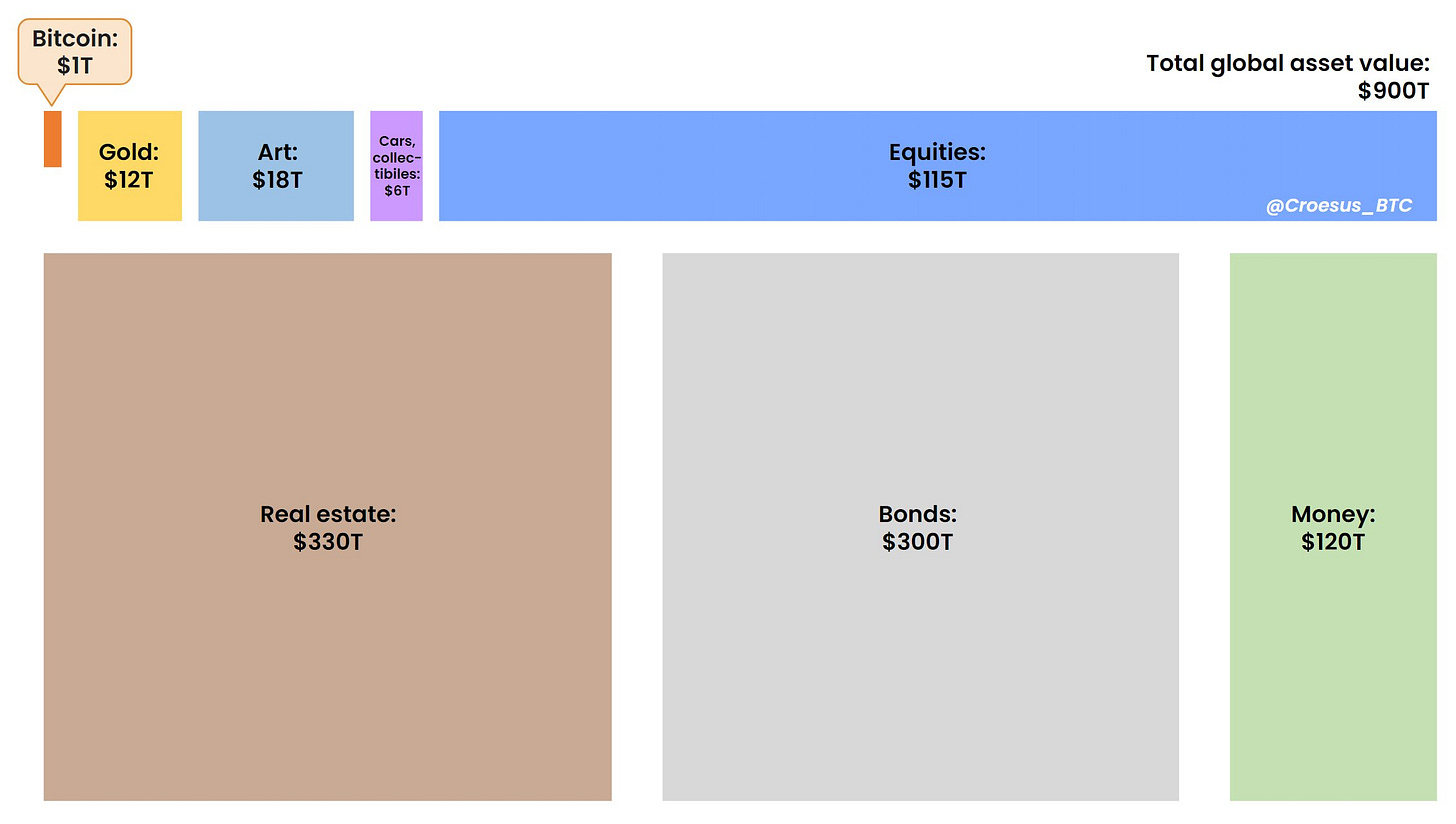

People often get the feeling that they’re “too late” to buy Bitcoin after seeing the large price appreciation it has experienced. What they miss is that in relation to other assets, Bitcoin’s market is quite small.

Source image: Jesse Myers

What does this mean long-term?

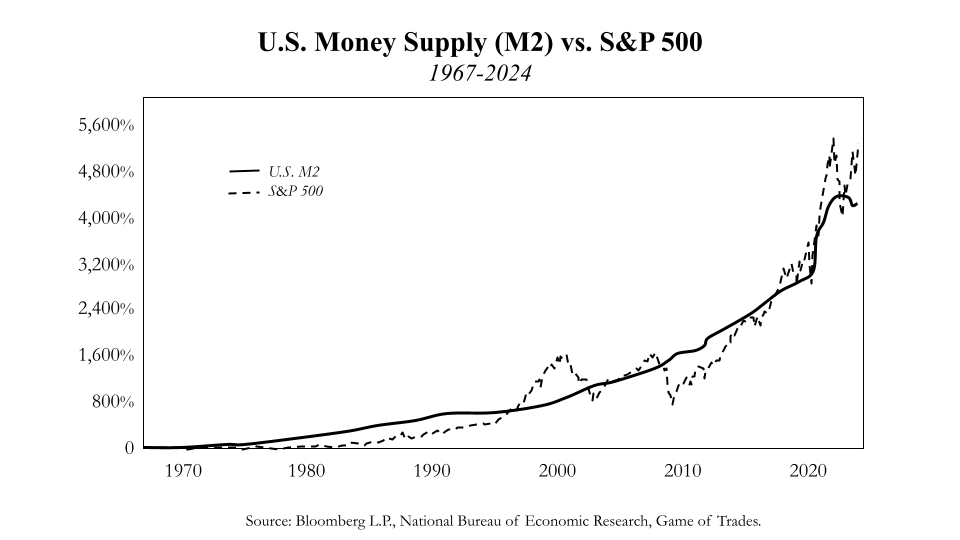

A major appeal for Bitcoin is the scarcity component, especially when considering a Bitcoin investment as a hedge against inflation caused by central bankers continuing to print money. A reduction in the amount of Bitcoin mined per block reduces the sell pressure of participating miners. The ETF approval earlier this year was an important step in legitimizing Bitcoin as an investment grade asset and facilitating easier purchase. For many, the simplicity of buying Bitcoin in a brokerage account without the hassle/risk of self custody is absolutely worth the 0.2-0.5% management fee. Due to the potential asymmetry in Bitcoin returns, it’s worth exploring buying an ETF within a tax advantaged account as I’ve done with my Roth IRA.

While many tout the returns of the S&P as an incredible success, what you’re essentially holding is a basket of assets maintaining their value in real terms while they trend up in nominal dollar terms. It doesn’t take a rocket scientist to see that both the dollar currency supply and the S&P have grown by 7% a year for 100 years. Dollars trade short-term price stability for long-term depreciation. Bitcoin trades short-term volatility for long-term appreciation.

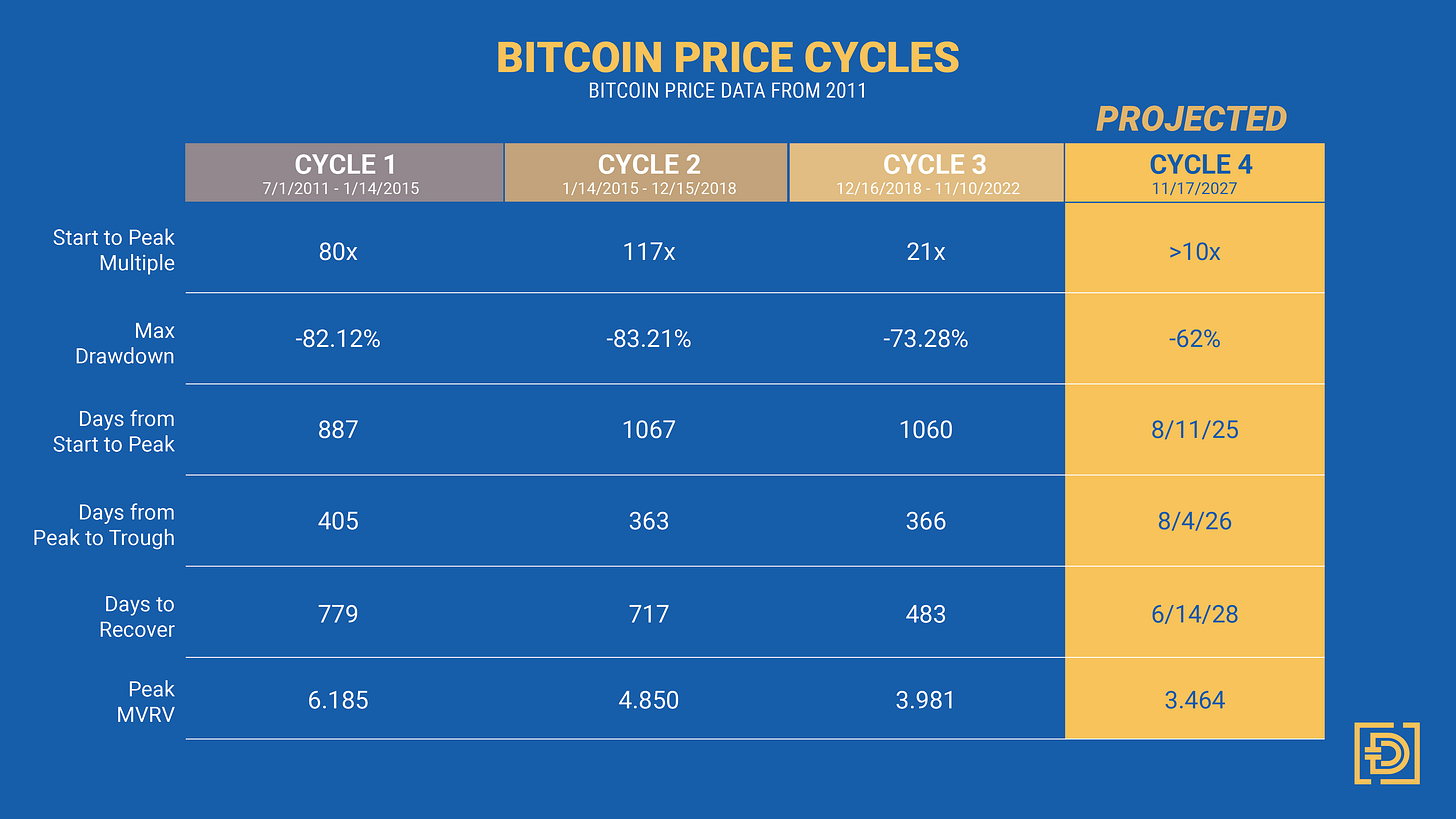

Price targets for the top of this halving cycle are tough to predict and will be affected by ETF demand that wasn’t present in previous cycles. A doubling in price of the current ATH at $75k would put us at $150k, roughly a 10x from the cycle bottom. The multiple of price appreciation has decreased each cycle and a 10x is not out of the question, particularly if another nation state invests in a major way, as El Salvador has done.

• 2012= $12 halving, $964 1yr later

• 2016= $663 halving, $2550 1yr later

• 2020= $8740 halving, $55801 1yr later

• 2024= ~$63300 at halving

Vanguard, with over $7 Trillion, doesn’t allow their clients to buy spot BTC ETFs. Fidelity, however, has been mining Bitcoin since 2013 and advises its investors to invest 1-5% of their net worth into Bitcoin. Even my own state of Arizona is attempting to include crypto as a part of the state retirement fund.

I expect that we chop around for the next few months between $60-75k before reaching new ATHs later this summer. Interestingly, in this cycle, Bitcoin reached ATHs in the two months leading up to this halving. Typically, the 6-9 months following a halving event is when we see the greatest amount of price appreciation. It will be interesting to see whether the recent increases in price disrupt historical patterns.

How do I get off Zero?

There is no perfect amount of Bitcoin that you should own, and the only incorrect allocation of Bitcoin is zero. Choosing a Bitcoin allocation as a percent of net worth is dependent on your risk tolerance, age, retirement goals, and the composition of the rest of your assets. Fidelity has a great report on this to advise a single digit allocation.

While looking at price charts, it can be tempting to try to time things and always buy the bottom, but dollar cost averaging is the right way to invest. Like your 401k, I recommend choosing an auto-buy amount you’re comfortable with and setting it to buy every week. I use Swan to automatically buy $50 in Bitcoin every week. Once my Bitcoin amount reaches a set threshold, I have it auto-withdrawn to a Trezor hardware wallet. I have been DCAing Bitcoin every week for 3+ years now and that, coupled with occasionally taking advantage of price dips, has been a rewarding strategy.

If you’re afraid of the responsibility that comes with self-custody, or the risk of holding on an exchange that could become insolvent, you can elect to purchase Bitcoin ETFs instead through your broker. These are my top tickers for Bitcoin ETFs, based on transparency of corresponding spot Bitcoin holdings to issued shares, as well as low management fees and sufficient liquidity:

IBIT - IShares Bitcoin Trust

FBTC - Fidelity Wise Origin Bitcoin Fund

BITB - Bitwise Bitcoin ETF

What about other tokens?

Diversification isn’t something that you need for crypto investing. Most other tokens are scams, vaporware, or won’t sustain growth through multiple cycles. If you’re trading shitcoins then you should base your unit of account in Bitcoin. The goal should be to stack more Bitcoin, or USD, through trading other cryptocurrencies and, besides Ethereum, I don’t see any reason to include them in your crypto portfolio.

Until you have stacked 0.1+ Bitcoin, you should not be buying any other cryptocurrencies!